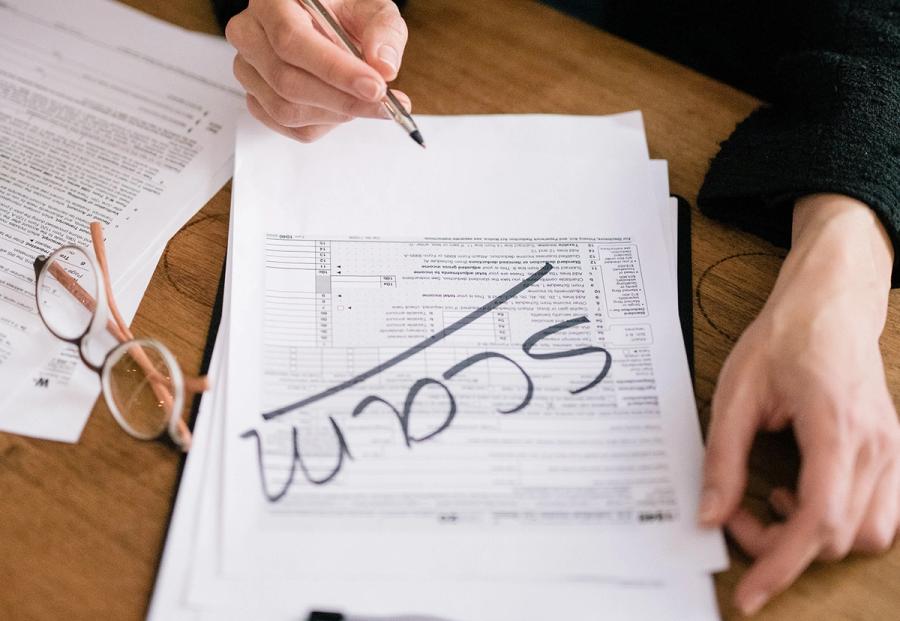

Buying a house is an exciting milestone in life, but it's crucial to remain vigilant throughout the process to avoid falling victim to real estate scams. Unfortunately, scammers are becoming more sophisticated, preying on unsuspecting homebuyers. In this article, we'll highlight four common real estate scams and provide valuable tips on how to protect yourself.

4 Common Real Estate Scams

1. Phishing and Email Spoofing:

- Scammers often send emails that appear to be from legitimate sources, such as your real estate agent, title company, or lender.

- Be cautious of unexpected emails requesting sensitive information or wire transfers.

- Verify the authenticity of any email by contacting the sender directly using a known and trusted phone number.

2. Bait-and-Switch Rental Scams:

- Fraudsters may advertise a property for rent at an attractive price, enticing potential homebuyers to wire a deposit or advance rent.

- Always visit a property in person before making any payments.

- Use reputable rental websites and work directly with established real estate professionals to minimize the risk of falling for rental scams.

3. False Title Companies:

- Scammers may create fake title companies or pose as legitimate ones to intercept funds during the closing process.

- Ensure that the title company you are working with is reputable and well-established.

- Double-check the contact information for the title company independently to avoid relying solely on information provided by other parties involved in the transaction.

4. Home Title Fraud:

- Home title fraud occurs when a fraudster gains access to your property's title and forges your signature to transfer ownership.

- Protect yourself by monitoring your home's title regularly for any unauthorized changes.

- Consider investing in a title monitoring and alert service, which can provide urgent alerts in case of title fraud.

How to Monitor Your Home's Title:

- Regularly check your property's title through your local county recorder's office or an online title monitoring service.

- Set up alerts for any changes in the title, such as new liens, mortgage loans, or unauthorized transfers.

- If you notice any discrepancies, report them immediately to the bank or mortgage lender as well as local authorities.

- Title Monitoring Services will help if you’re a title fraud victim, a Restoration Team works with lawyers and experts to help restore your title.

In Conclusion:

While the home buying process is an exciting journey, it's essential to be aware of potential scams that could jeopardize your investment. By staying informed and taking proactive steps to protect yourself, you can minimize the risk of falling victim to common real estate scams. Always verify information independently, work with reputable professionals, and monitor your home's title regularly to ensure a secure and smooth home-buying experience.